Integrating Applications with Q2 Digital Banking

Posted By Nueve Solutions on June 19th, 2020

It has been incredible to watch the evolution of Q2’s platform over the past few years. Their team has enabled the platform to be extended in ways that suit the variety of needs financial institutions face today. The platform does not force a one-size-fits-all approach, and we believe they strike a very good balance between flexibility and control.

Currently there are two main approaches to extending the Q2 platform: the SDK (software development kit) and the SSO (single sign-on) approach.

Q2 Mobile Banking Experience

Before I jump into the finer details of these two approaches, I would like to stress the fact that both approaches have a phenomenal mobile experience, integrating seamlessly with Q2’s mobile apps.

The mobile experience for a customer is one of the most important considerations to take into account when integrating and extending a banking application. The ability to load applications in the mobile app is a distinct advantage of Q2’s platform. The application loads in the mobile app with a responsive look and thus provides an excellent mobile banking experience for the customer.

SDK vs. SSO Applications

A seamless flow can be achieved for both SDK applications as well as SSO third-party applications. When using the SDK, the user interface is tightly coupled to Q2, so the design will match exactly. However, the app can never work outside of Q2’s platform.

To determine which approach of the two will work best, consider what you are looking to accomplish through the app. If one or more of the following statements apply, then designing an app with SSO would be preferable to creating one with the SDK:

- You need your app to be able to work with other platforms.

- You have the possibility of changing platforms in the future.

- The third party application you need to integrate already exists.

For example, if you already have a budgeting app and would like to integrate it with your bank, designing an app with SSO would be preferable to using SDK to create the app. With the SSO app, a member would begin with logging in to his digital banking account on a website or mobile app. The member would then be seamlessly transferred to the budgeting app without having to log in a second time.

Building an App with Q2 SDK

If a banking app is built using Q2 SDK, the app will be fully integrated with the digital banking experience. The color scheme of the bank can be on the app, and the mobile experience would look great since it would be tightly coupled with the banking website. However, if the app needs to be integrated with another platform, then the app would have to be completely rebuilt.

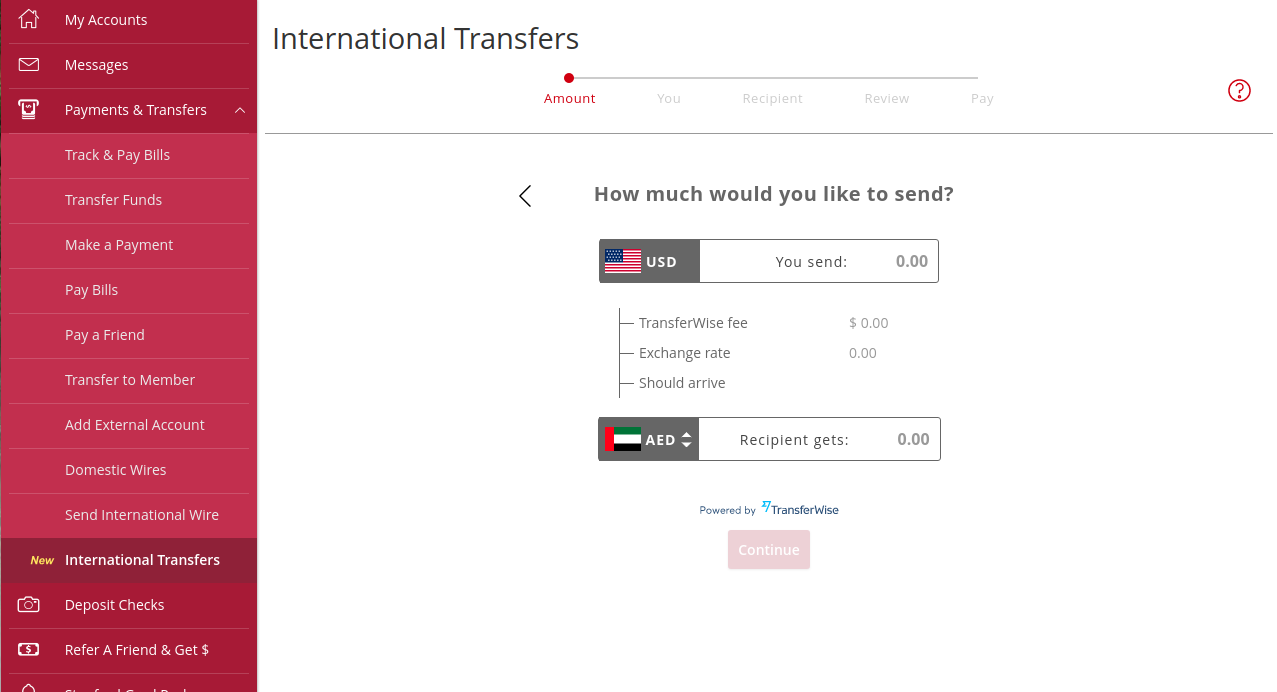

Below is an example of an integrated application built with the Q2 SDK. You can see that the color of the Amount and Continue buttons match the color scheme of the menu. The right side is the application and it is integrated with the financial institution’s online banking. However, keep in mind that this application is so tightly integrated that it will never work outside of Q2’s platform.

Building an App with Q2 SSO

One of the greatest advantages when building an SSO login to the app is that it will not need to be rebuilt with Q2 SDK. This can save valuable time and money, particularly if you are looking to integrate with other financial institutions, other apps, or platforms outside of Q2’s ecosystem. One potential disadvantage with an SSO login is that the user flow experience will not be tightly integrated. Keep in mind, if the color scheme of the website does not match the app, additional work may need to be done in order to match the color scheme.

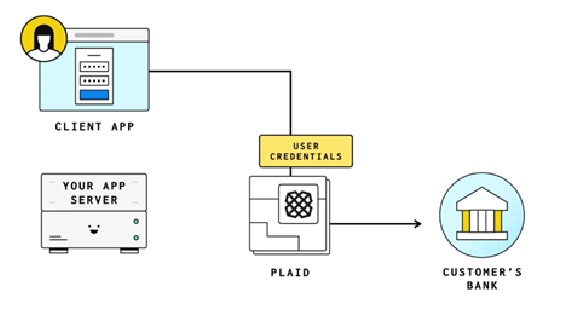

For example, assume you have an application and it’s not feasible to rebuild with Q2’s SDK. Q2 Caliper SDK has a solution in that case. If your application can support SSO, Q2 digital banking members can sign in automatically to your application.

When a member clicks on the app icon in the menu, Q2 can do an SSO flow. Q2 will be the identity provider and supports SAML authentication. The application will be the resource and can let the members login automatically. Q2 provides an overpanel, and the application can load in an overpanel or a separate tab.

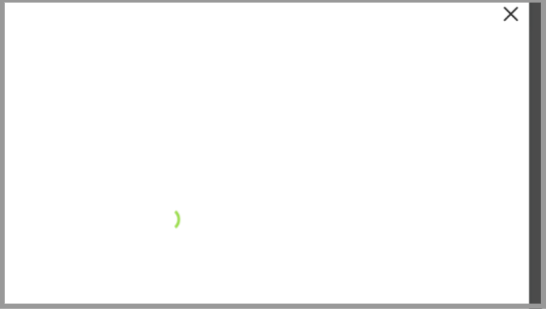

You can see the below overpanel covering the menu. You can see that the overpanel is waiting to load the external application. Customers can close the application by clicking on the top right corner close icon. This gives the third party application a seamless experience with Q2.

Application Display Options

When designing the app, you can choose to have your app be part of the digital banking menu. After the member clicks on the app in the menu, your app would be displayed in one of the following two ways:

- Assuming your application provides APIs, we can build your application functionality with Q2 SDK APIs. When a member navigates to the application, the interface will look very nice, since the app looks good integrated with digital banking.

- Assuming you have an application in which it is not feasible to rebuild with Q2 SDK, Q2 Caliper SDK has a solution. If your application can support SSO, Q2 digital banking members will be able to sign in automatically to your application. When a member clicks on the app icon in the menu, Q2 can do a SSO flow. Q2 will be the identity provider and supports SAML (Security Assertion Markup Language) authentication for security. The application will be the resource service provider, and the application is able to let members login automatically. Q2 provides an overpanel, and the application can load in an overpanel or a separate tab. For the mobile banking app, the website would load within the app, so that the application loads in the mobile app with a responsive look.

| Pros | Cons | |

| Q2 SDK | Tightly integrated experience | Application will not work outside of Q2s platform |

| Q2 SSO | Application can integrate with many banking platforms | Additional work may need to be done to make the experience feel the same |