Free up your loan officers to bring in more business by spending more time meeting with borrowers and selling loans rather than doing data collection, validation, and entry.

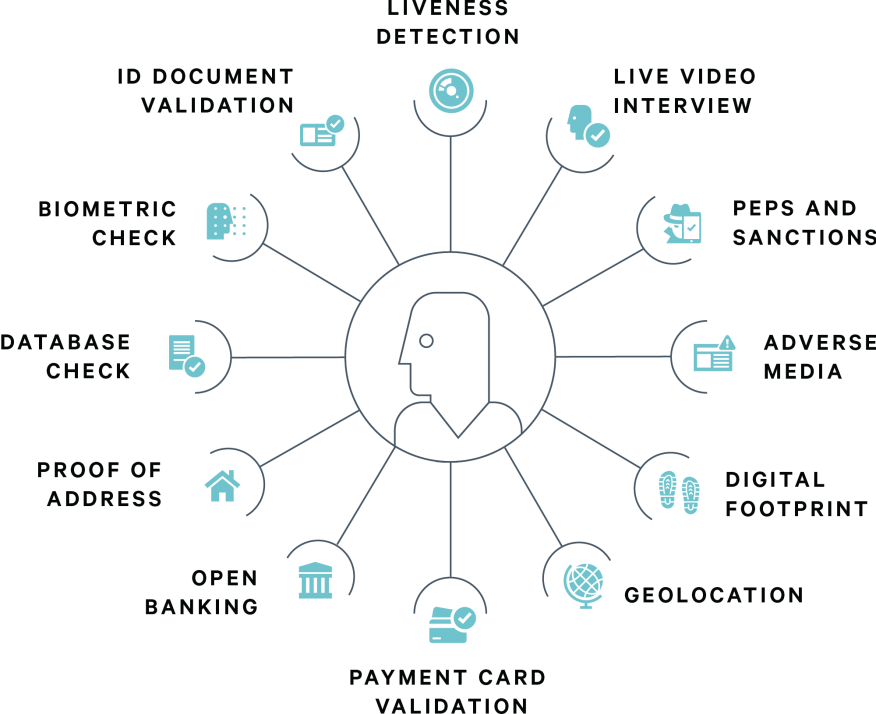

KYC: Automate your KYC compliance with identity verification services. One such service is the Mitek Verified Identity Platform, which allows you to orchestrate identity verification technologies such as:

- Database checks

- PEP screening

- Sanctions checks

- Liveness detection

- Facial biometrics

- ID document validation

- Proof of address checks

- Configure document recency rules

For example, you can create a guided journey where the borrower submits a picture of their photo ID and a selfie, and then you receive results as to the validity of the photo ID, the results of the checks and screenings you configured, and a pass/fail result with a score.

Loan Setup: Automate collection of data from different sources (such as government websites, appraisal, borrower documents, etc.) and enter the data into the LOS.

Other automatable origination tasks:

- Employment verification

- Initial disclosures – create and send initial disclosure package within LOS

- Order credit – order Undisclosed Debt Notification (UDN) report within LOS

- Rate lock requests – scrape and validate data from email request

- AUS – run automated underwriting service