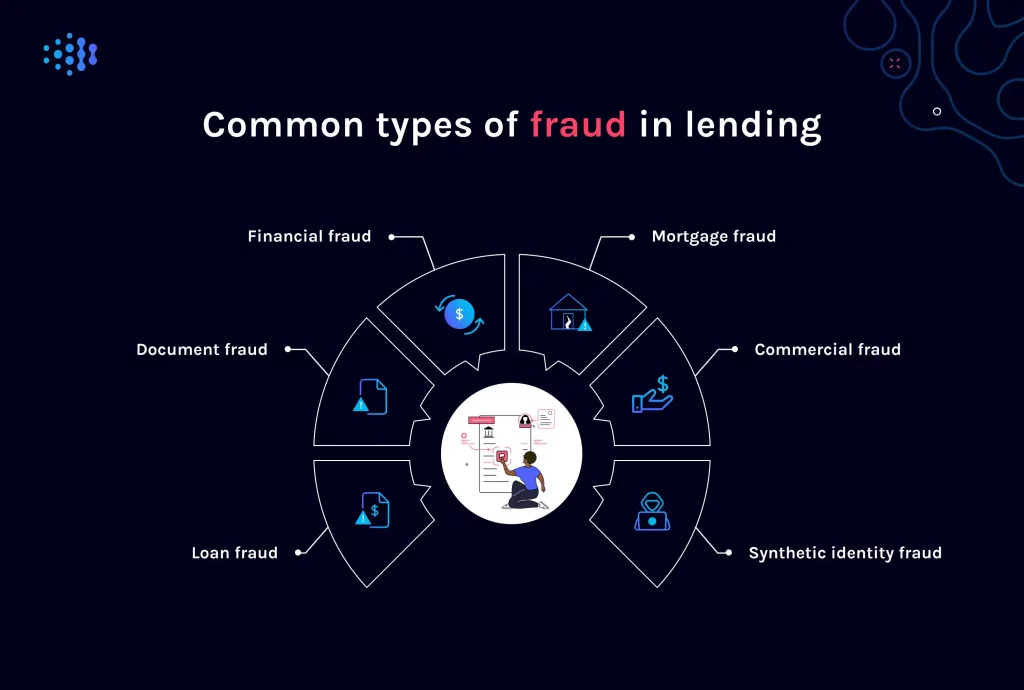

Document Fraud Detection: Identifying suspicious activities is a manual process in the traditional mortgage workflow. But technology can enable lenders to focus on inconsistencies, with potential red flags resulting from automated analysis of borrower documents and data. With tools such as Ocrolus Detect you can automatically identify fraudulent or tampered information across documents that pose a risk to your business. Detect highlights, or signals, fraudulent or tampered document data for you to review, and even can show you the original data from the document.

Other automatable tasks:

- Detect if appraiser has history of inflating property values.

- Use AI to detect inconsistencies.

- Identify information that borrowers may not have disclosed, such as undisclosed properties, hidden debts, bankruptcies, and forged documents.